Jesús Sotomayor interprets what can happen beyond Covid-19 to the Oil and Gas Industry following the article “Beyond the coronavirus: the path to the next normal” written by Kevin Sneader and Shubham Singhal of McKinsey and Company to locate us in the new situation of any business caused by the effects of the coronavirus (COVID-19) and, specifically, in the Oil and Gas Industry.

For this, parts of the document are used literally, as a means to predict the commercial impact and the actions required by the Leaders that influence the Oil and Gas Production Assets that are deeply affecting the Oil and gas industry. , to overcome the COVID-19 effect in the “near normal” market.

The coronavirus is not only a health crisis of immense proportion—it’s also an imminent restructuring of the global economic order. Here’s how leaders across the public, private, and social sectors can begin navigating to what’s next.

Clearly a new era “next normal” will be defined after COVID-19. In this unprecedented new reality, we will witness a dramatic restructuring of the economic and social order in which business and society have traditionally operated. We will see the beginning of discussion and debate about what the next normal could entail and how sharply its contours will diverge from those that previously shaped our lives.

Response to the coronavirus crisis

In almost all countries, crisis-response efforts are in full motion. A large array of public-health interventions has been deployed. Healthcare systems are “on a war” trying to increase their capacity and capabilities under shortages of much-needed medical supplies. Business-continuity and employee-safety plans have been escalated, with remote work operating mode. Many are dealing with acute slowdowns in their operations, while some seek to accelerate to meet demand in critical areas: food, supplies, and goods. Educational institutions are moving online to provide ongoing learning opportunities as physical classrooms shut down.

And yet, a toxic combination of inaction and paralysis remains, stymying choices that must be made: lockdown or not; isolation or quarantine; shut down the factory now or wait for an order from above.

The pandemic has metastasized into a burgeoning crisis for the economy and financial system. The acute pullback in economic activity, necessary to protect public health, is simultaneously jeopardizing the economic well-being of citizens and institutions. A health crisis is turning into a financial crisis as uncertainty about the size, duration, and shape of the decline in GDP and employment undermines what remains of business confidence.

McKinsey Global Institute Analysis

A McKinsey Global Institute analysis, indicates that the shock to our livelihoods from the economic impact of virus-suppression efforts could be the biggest in nearly a century. This decline in economic activity in a single quarter proves far greater than the loss of income experienced during the Great Depression.

A shock of this scale will create a discontinuous shift in the preferences and expectations of individuals as citizens, as employees, and as consumers. These shifts and their impact on how we live, how we work, and how we use technology will emerge more clearly over the coming weeks and months. Institutions that reinvent themselves to make the most of better insight and foresight, as preferences evolve, will disproportionally succeed. Clearly, the online world of contactless commerce could be bolstered in ways that reshape consumer behavior forever. But other effects could prove even more significant as the pursuit of efficiency gives way to the requirement of resilience—the end of supply-chain globalization, for example, if production and sourcing move closer to the end user.

The near future

Most industries will need to reactivate their entire supply chain, even as the differential scale and timing of the impact of coronavirus mean that global supply chains face disruption in multiple geographies. The weakest point in the chain will determine the success or otherwise of a return to rehiring, training, and attaining previous levels of workforce productivity.

Compounding the challenge, winter will bring renewed crisis for many countries. Without a vaccine or effective prophylactic treatment, a rapid return to a rising spread of the virus is a genuine threat.

Governments are likely to feel emboldened and supported by their citizens to take a more active role in shaping economic activity. Business leaders need to anticipate popularly supported changes to policies and regulations as society seeks to avoid, mitigate, and preempt a future health crisis of the kind we are experiencing today.

A healthcare system will need to determine how to meet such a rapid surge in patient volume, managing seamlessly across in-person and virtual care. Public-health approaches, in an interconnected and highly mobile world, must rethink the speed and global coordination with which they need to react.

Decisions about how far to flex operations without loss of efficiency will likewise be informed by the experience of closing down much of global production. Opportunities to push the envelope of technology adoption will be accelerated by rapid learning about what it takes to drive productivity when labor is unavailable.

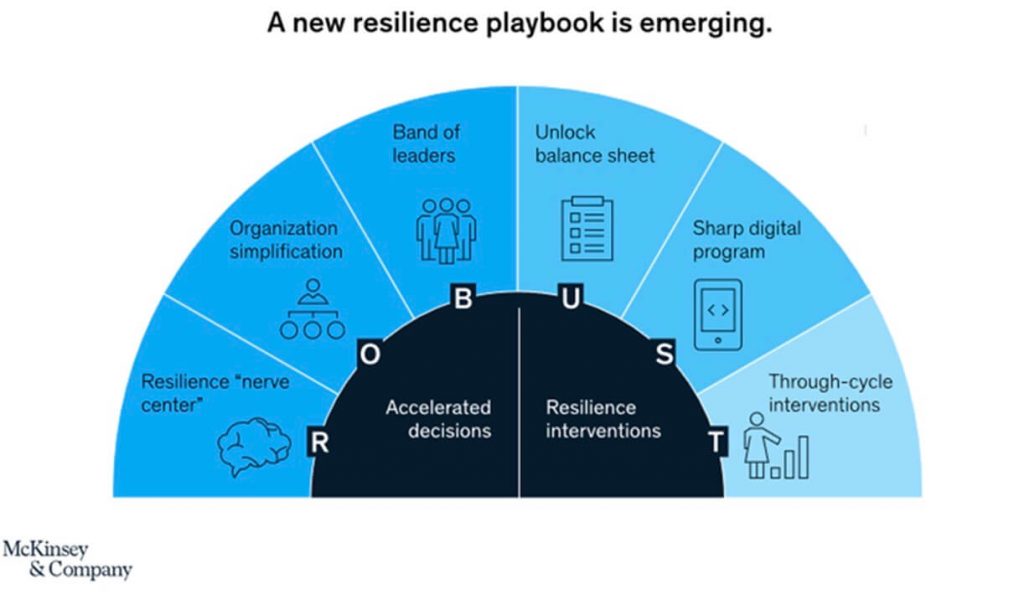

The following graph shows the emerging resilience ROBUST organisation scheme to overcome with success the CONVID-19 business uncertainty status.

The 5 Stages

Answer is a call to act across five stages, leading from the crisis of today solving now for the virus and the economy, to the next normal reimagining the future, post-pandemic, that will emerge after the battle against coronavirus has been won: Resolve, Resilience, Return, Reimagination, and Reform.

The duration of each stage will vary based on geographic and industry context, and institutions may find themselves operating in more than one stage simultaneously.

Applying the study to the Oil and Gas

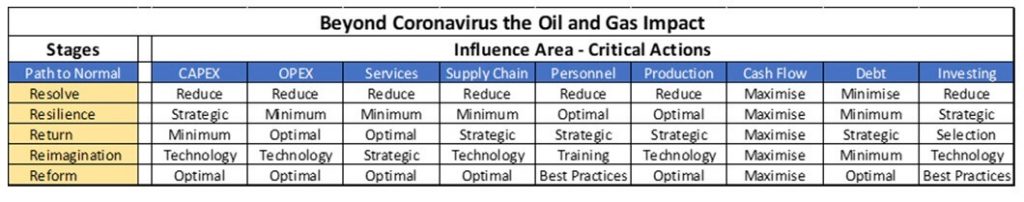

Resolve

Leaders will need to determine the scale, pace, and depth of action required at the state and business levels.

Oil and Gas Impact:

CAPEX and OPEX reduction impacting Services, Supply Chain, Personnel; Production reduction impacting Cash flow, Debt, Investments; Production Risk increase impacting revamping timing.

Resilience

In the face of these challenges, resilience is a vital necessity. Near-term issues of cash management for liquidity and solvency are clearly paramount. But soon afterward, businesses will need to act on broader resilience plans as the shock begins to upturn established industry structures, resetting competitive positions forever.

Much of the population will experience uncertainty and personal financial stress. Public-, private-, and social-sector Leaders will need to make difficult “through cycle” decisions that balance economic and social sustainability.

Oil and Gas Impact:

Services, Supply Chain, Personnel key parts for business success being hurt impacts readiness to normal operations; Cash flow, Debt, Investments will define strategic actions; Production Risk will be driven by market supply and demand timing.

Return

Returning businesses to operational health after a severe shutdown is extremely challenging.

Leaders must therefore reassess their entire business system and plan for contingent actions in order to return their business to effective production at pace and at scale.

Oil and Gas Impact:

Services, Supply Chain, Personnel due to optimisation a compromise is required to improve processes; Cash flow, Debt, Investments with business-oriented decisions; Production Risk reduction by implementing lessons learnt and digitalisation.

Reimagination

The crisis will reveal not just vulnerabilities but opportunities to improve the performance of businesses.

As a result, Leaders will need to reconsider: a stronger sense of what makes business more resilient to shocks, more productive, and better able to deliver to customers.

Oil and Gas Impact:

Services, Supply Chain, Personnel the technology, contactless on-line business and training will be the key; Cash flow, Debt, Investments oriented to increase market share at minimum cost; Production Optimisation with maximum efficiency with technology.

Reform

The aftermath of the pandemic will also provide an opportunity to learn from a plethora of social innovations and experiments, ranging from working from home to large-scale surveillance. With this, Leaders will need to understand which innovations, if adopted permanently, might provide substantial uplift to economic and social welfare—and which would ultimately inhibit the broader betterment of society, even if helpful in halting or limiting the spread of the virus.

Oil and Gas Impact:

Services, Supply Chain, Personnel the successful practices applied will indicate the way forward; Cash flow, Debt, Investments embraced by decisions adjusted to market reality; Production Optimisation with quick implementation of technology and best practices applied during the pandemic period.

In summary

As we consider the scale of change that the coronavirus has engendered—and will continue to engender in the weeks and months ahead—we feel compelled to reflect not just on a health crisis of immense proportion but also on an imminent restructuring of the global economic order. How exactly this crisis evolves remains to be seen. But the five stages described here offer leaders a clear path to begin navigating to the next normal—a normal that looks unlike any in the years preceding the coronavirus, the pandemic that changed everything.

A summary of the pandemic five stages affecting the Oil and Gas Production Assets and actions for the “next normal” operation, is shown below.

The following is a summary of the five stages of the path of normality, beyond the pandemic, that influence Assets and actions in the Oil and Gas Production value chain.

Leave A Comment